Last week, I wrote about several mansions/historic homes that we visited on our 36th anniversary trip. One of the docents made a comment about how hard it was to piece together history about the people who had built, and subsequently dwelt, in the home during the 100 years or so before it became a museum. She talked about how nice it would be if people would record things like the reasons why they purchased or built their homes, and how much it cost to purchase or make improvements on their properties.

Her comment made me reflect on our own houses, and what we did to make them homes, for our family through the past 36 years.

In the late 1980’s, we were married and started our home-life in a 2-bedroom apartment. I remember that it was important to Ray that I let go of my small business “Rechelle’s Personnel Touch” so that I would be devoted to making our house a “home” in those early years. (Eventually, I did return to work for a season before we started our family, but that is another story…)

Anyway, I remember glimpses of our time in the apartment, trying to learn how to keep a home with the laundry, cleaning, cooking, having company often, and going, going, going as young people within our small church community at the time. To our surprise, we were able to purchase a one-bedroom condominium after only a year of renting the apartment. However, I recall this decision putting a strain on Ray that I wasn’t prepared for at the time. He worried about being able to make the payments, and to keep up with the property taxes and mortgage interest so that we wouldn’t lose what we had invested in at our young age.

Then, we found out we were expecting our first baby almost a year ahead of the schedule we thought would be practical for our situation at the time.

After Kacia was born, there were some limitations with the little condominium we had made into our home, and we felt the need to expand to something more suitable for family life. Thanks to some help from a beloved family member, and several factors that worked together for this change, we were able to move into a beautiful little 2-bedroom condominium that seemed perfect for our young family. It had a garden window in the kitchen, large bathrooms for each bedroom, a one-car garage for parking (and storage), and some great amenities including a large grass area, pool, and hot tub. Other young couples and families we knew were moving into larger, or more stylish, houses, but we were not measuring our happiness with our blessing by comparison to them and their situations. We were just thankful for our new house and strove to make it a home for us and our new baby girl.

We were still living in our 2-bedroom condo and expecting our 4th baby, and I was feeling pretty discouraged about being able to manage the space for 6 people. I was anxious for a change. The market, and our financial situation at the time, was not indicating that we would be able to afford something that would really feel like a suitable home for a family of our size, but God blessed our family with a home that would be a place of growth and hospitality for many years.

We moved inland from Orange County to a 4-bedroom home when our 4th child was 8 weeks old. I began homeschooling our kids a few months later. Two large home addition construction projects and eight years later, we had our last born child, Levi.

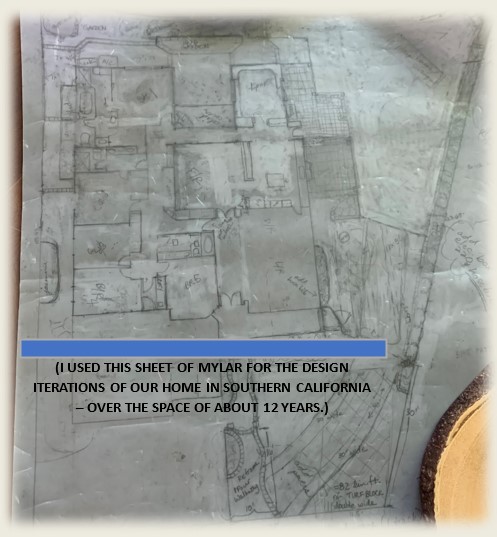

I designed all of the yard spaces, floor plan changes, and additions that we completed during the 14 1/2 years we lived there. I remember lots of days I spent homeschooling the kids, cooking, cleaning, and then staying up to wee hours of the morning working on conceptual design drawings. In 1999, we built a school room and added four feet of space to the whole side of the house that expanded the kitchen, dining room, and formal living room. Then 3 years later, Ray agreed to let me build a new master suite so we would have an extra bedroom for a fifth child. This would be the first and only time we would have a nursery dedicated to a new baby instead of moving a baby into someone else’s bedroom! We had lots of family memories, out-of-town guests, gatherings, parties, and even hosted church in our home when needed on occasion through those years.

We thought our 5-bedroom, 3-bath home would be our “forever home,” and didn’t worry when the housing market was plummeting in 2009 because of the mortgage crisis. It wouldn’t have been a problem if we would have continued living in Southern California, but our church life was in shambles by the end of 2010. We had a family meeting in the beginning of 2011, and told our kids we were going to make drastic changes to our spending and finances so we could attempt to move to Oregon as soon as possible. Ray asked our two oldest kids, who were both adults, if they would be willing to wait with us instead of moving to Oregon before us, and they both agreed. Two weeks after our family meeting, Ray was laid off from his job, and told me God gave us the answer. We spent that day putting our “forever home” on the market, planning what we would sell, and how we would transport our family and the vehicles we would keep for our new life in Oregon.

We couldn’t afford to rent a house, no apartment complex would rent one unit to a family of seven people, and the RV Resort was hesitant to allow us to live there in our 31 foot Class C motor home with such a big family. Finally, the manager agreed to let us make Premier RV Resort our destination in Eugene, Oregon. I remember trying to figure out the minimum amount of clothes, supplies, and kitchen ware that we would need to carry on life in our motor home while everything else would go to storage, and thinking, “Oh, I hope we don’t have to do this for more than 2 weeks!” I just knew that God was delivering us in a mighty way, and figured it would be simple for Ray to find work so we could get settled in our new life. But this was another example of how God works out his plan in ways we don’t expect.

We ended up having to complete a short sale on our home back in California, and Ray didn’t land a job that would financially allow us to move out of the RV park until 8 months after we rolled into our temporary home.

At the time it felt like a lot longer than 8 months to me, but then we were able to a rent a really nice 3 bedroom home, Kacia got married, and Lukas stayed in the motor home another 3 months until he and a friend moved into a duplex nearby. The time frame for being able to stop renting and purchase a home was much shorter than what would be expected, because of President Obama’s “Back to Work” program. In the fall of 2013, Ray and I were out on a date & listening to Clark Howard on the radio. We heard him listing the qualifications to be able to return to home ownership with a special FHA loan after going through a short sale on a primary residence. Ray and I were stunned, because Clark Howard was essentially describing our situation! Ray was out of work for several months, then recovered “up to 80%” of his previous income, we moved more than the required miles away from our previously owned home, etc. The home we purchased was somewhat outdated, and I knew that if we could perform meaningful, minor improvements, we could increase the value enough to refinance to a conventional loan without primary mortgage insurance premiums. We got a small second mortgage to update the bathroom, kitchen, and laundry room and used the money we were saving in the new loan to pay down the second as quickly as possible.

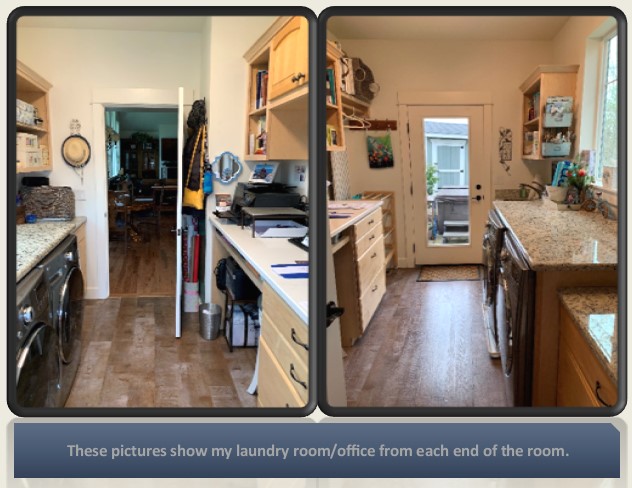

A few years later, we talked about expanding the dining room for our family gatherings (everyone was moved out except Levi) and garage for Ray’s woodshop. I started comparing the projected cost to the possibility of starting from scratch on a newly built home. We sold our home, purchased a quarter of an acre in a development going in (closer to the bike path than the previous home!), and rented a small home while our new house was being designed and built. Early in the process, our builder told me he was having difficulty finding a floorplan that would fit within the limitations of the property because of the natural conservation and easement setbacks, so it was the perfect opportunity for me to design our own floor plan to be sent to the designer/architect for the official build plans. The way things worked out with our builder, Ray and I ended up contributing much more than just the floor plan. This turned out to be a huge blessing in disguise, because we were able to complete several “build items” after we moved in at a fraction of what it would have cost. The carpeting was required to be completed prior to sign-off on the build, but we were able to hire a friend to install all of the hardwood and vinyl flooring after we moved in. We were able to take our time to set up the electrical for his woodshop and the hot tub, design and install the hot tub space and adjoining patio, complete the laundry room and pantry cabinetry, and a host of other objectives that were on the list at some point of the build process but not necessary for “build completion.”

We have enjoyed this home very much, and can now see how much better it is that we have been planted in a dwelling considerably smaller than what we thought would be our “forever home” in California. After all, we are back to just the two of us living together instead of a large family bursting at the seams. We now have a dining room big enough for family gatherings, a woodshop for Ray to do his projects, a home office that Ray has needed since COVID (he has worked from home since just after we moved in!), and a separate office in my laundry room for me to work at my “dream job” right here at home.

Looking back, it is easy to see that whether we were crammed into less than 300 square feet or spread out in 3,000 square feet, it was the life and love we had that made our dwelling place. We have had joys and trials, guests and meals, love and laughter, and times to treasure in every house we called home.

Leave a comment